The moment you get home with your new pet, you’re responsible for making sure they stay healthy. That’s why pet insurance is such an important idea. Pet insurance should offer coverage that meets your dog or cat’s healthcare needs — general care, plus high enough limits to provide a cushion in case of a medical emergency.

Pet insurance can lower the costs associated with visits to the vet, just like health insurance does for humans. But, there are a lot of bad deals out there, which have led many pet owners to skip out on insurance altogether.

Below, we’ll look at some of the best affordable options for keeping your pet healthy in 2019 and beyond. Let’s have a look, shall we?

Best affordable pet insurance for 2019

Trupanion

Trupanion offers complete medical coverage with no annual limits on payouts. It’s also one of the few pet insurance providers that pays vets directly. This is a pretty big deal, as many providers require that you submit a claim for reimbursement after paying fees upfront.

The Trupanion website lays out some pretty solid benefits right off the bat. Most notably, the company offers 90% coverage of all eligible costs; including hereditary and congenital conditions.

Policyholders can visit any veterinarian in the U.S., Puerto Rico, or Canada, and they promise to never raise your rate — even if your pet requires a whole bunch of visits to the doctor.

Overall, it’s clear from the testimonials and the 5-star Trustpilot rating that Trupanion is a great option for pet owners seeking the most bang for their buck.

Healthy Paws

Healthy Paws is another favorite plan — it’s got great reviews across the web and is one of the lowest cost options out there. Customers have raved about the services provided, and the short 15-day waiting period for injury and illness coverage.

The only caveat is, Healthy Paws is best for younger pets. Pets older than six will receive fewer, less generous benefits than their younger counterparts, and if you have a large dog, the company requires a 12-month waiting period on hip dysplasia, a condition that affects large dogs as they age.

Hip dysplasia is treated with pain medication in many cases, however, severe cases may require surgery which can get expensive, topping $7,000 in many cases.

That said, if you have a smaller, younger pet, Healthy Paws is a solid option.

Figo

We like Figo , as the insurance company comes with some distinct advantages over some of the other plans we’ve reviewed. Figo provides a cloud-based record keeping system called Pet Cloud. Not only can you quickly access records, but you can also track microchipped pets — a real lifesaver in the event that your pet runs away.

Figo offers three tiers of health coverage, all of which include comprehensive protections. Plans range from $10,000 to $14,000 in coverage in a given year, or you can choose an unlimited plan for a higher premium.

Figo’s coverage means the company pays vet exam fees when the exam is related to a specific accident or illness. So in the event that your pet gets bit by another animal or breaks a bone, you won’t pay for the office visit.

How to make sure your cat uses the litter box

Embrace

Embrace is one of the lowest cost pet insurance providers we found during our research. This company offers no per-incident limits on claims, no lifetime limits, and an A+ rating with the BBB. Claims are paid within 5-15 days, and if you have multiple pets, you may be eligible for a discount.

Like Healthy Paws, Embrace puts some hip dysplasia limits in the policy. There’s a six month waiting period for care related to the condition — but plans will cover at least part of the costs in the event your dog needs to have hip surgery.

What we like about Embrace is that plans come with an annual allowance for wellness care, which can be used for vaccinations, microchipping, and check-ups. And you even get a 10% discount if you’re covering more than one pet.

Bottom Line

Whether you decide to buy pet insurance boils down to a few different elements. It’s an emotional decision that impacts the quality of care your furry family members receive.

It’s important to understand that pet insurance works a bit differently than human health insurance. The main difference is, when you go to the doctor, you’ll pay for medical bills at the rate predetermined by your provider. Conversely, when you take your pet to the doctor, you’ll typically cover the fees yourself and apply for reimbursement — kind of like car insurance.

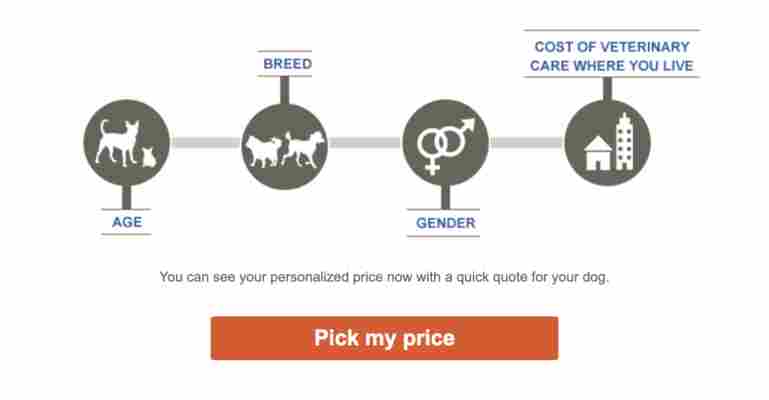

Make sure you look for a policy that covers both illnesses and injuries. Most plans don’t cover preventative care, so you’ll also want to consider that you’ll still be paying for routine care. Finally, as we’ve seen with Healthy Paws, pet insurance rates and coverage depends on your pet’s age and sometimes, size. As such, read the fine print closely before signing a contract.

More about pets

5 best online shopping sites for your pets ►

Best home and pet sitters to use while on vacation ►

Top 5 apps for pet owners ►

Top 5 YouTube channels for pet owners ►